Savings Account Singapore

Are you looking for a simple way to grow your money? Look nowhere else! We have compiled the top higher-interest savings accounts in Singapore to assist you in reaching your financial objectives. These accounts have amazing features made just for you to meet your needs and make your money work even harder for you. You’ll appreciate the ease and security they offer, assuring that your hard-earned money is in capable hands.

These accounts have many advantages, and we’re thrilled to share them with you because they’re made to make saving money easier. The increased interest rates will benefit you because they will allow your money to grow more quickly.

They also provide a variety of benefits, like as cashback rewards and special promotions, to enhance your banking experience. We think that these savings accounts are the best options available in Singapore because they are tailored precisely to your preferences and financial needs.

Why then wait? Explore our list of Singapore’s top savings accounts to get started putting your money to work for you right away.

Best savings accounts in Singapore (Updated 2024) – Interest rates and links included.

Best savings accounts in Singapore (Updated 2024) – Interest rates and links included.

Our team of experts have researched and curated a list of the best savings account in Singapore. Our list of recommendations are based on ours and others' first-hand experience, so it will be helpful for you! Let's not wait and get to it!

There are many banks to choose from in Singapore, as well as the different account types. Here is a table summary of the Best Savings Accounts in Singapore!

| Savings Account | Interest Rates | Details |

| 1. DBS Multiplier Savings Account https://www.dbs.com.sg/personal/deposits/bank-earn/multiplier | Up to 3.00% p.a | Saver and spender using Paylah! |

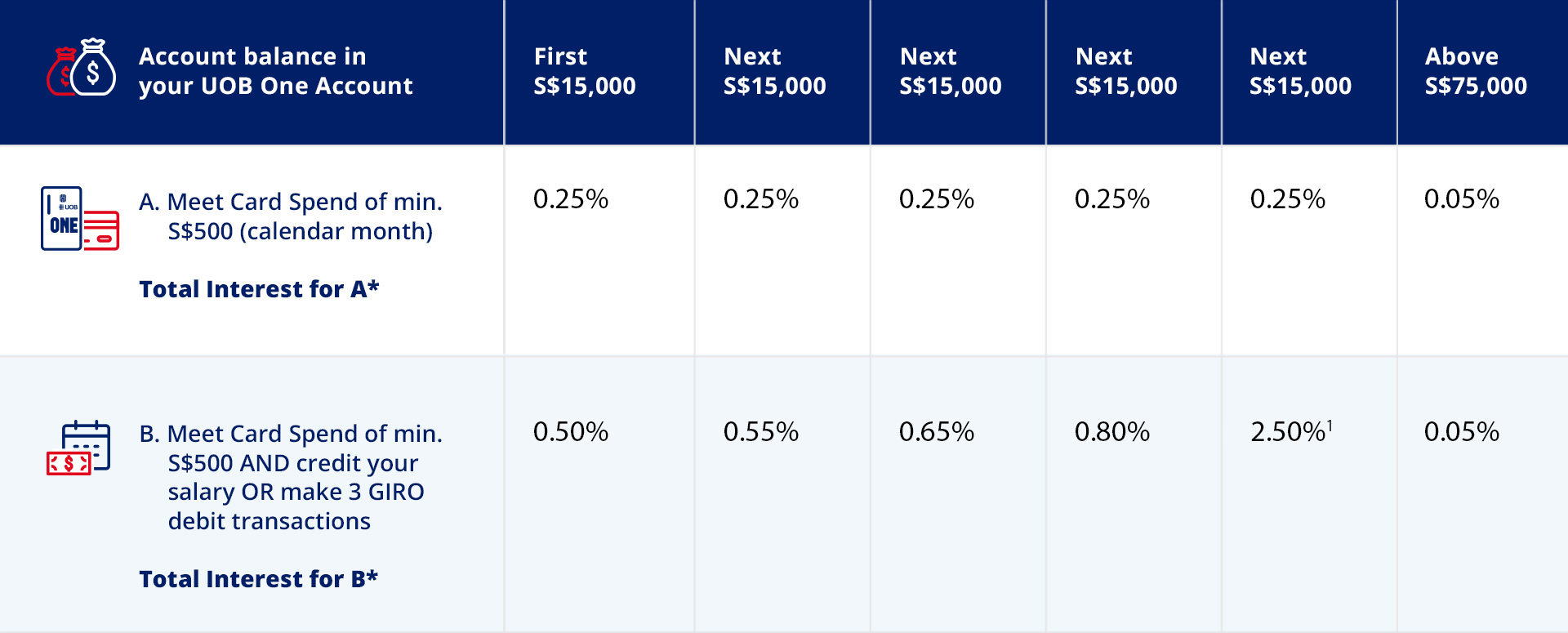

| 2. UOB One Savings https://www.uob.com.sg/personal/save/chequeing/one-account.page | From 0.25% – 2.5% p.a | Crediting Salary on GIRO |

| 3. OCBC 360 Account https://www.ocbc.com/personal-banking/deposits/360-savings-account | Up to 2.38% p.a | All in one bank account. |

| 4. MayBank Save Up Account https://www.maybank2u.com.sg/en/personal/saveup/save-up-programme.page | Up to 3.0% p.a | All in one bank account |

| 5. Standard Chartered Bank Bonus $aver https://www.sc.com/sg/save/current-accounts/bonussaver/ | Up to 2.38% p.a | Making bills payment |

| 6. Bank of China Smart Saver https://www.bankofchina.com/sg/pbservice/pb1/202007/t20200731_18212078.html | Up to 3.0% p.a | Salary crediting and card spender |

1. DBS Multiplier Savings Account

| Details | Saver and spender using Paylah! |

| Interest Rates | Up to 3.00% p.a |

| Website | https://www.dbs.com.sg/personal/deposits/bank-earn/multiplier |

| Initial Deposit | No initial deposit required. No monthly account fees. |

| Minimum Balance | Service charge of S$5 if average daily balance falls below S$3,000 (based on total SGD equivalent of SGD & foreign currency balances). This service charge is waived for you up until 29 years old. Offers |

We believe the DBS Multiplier Savings Account is a fantastic choice for you because it offers flexibility and customization based on your financial needs. The various categories, such as credit card spending and home loan contributions, allow you to unlock higher interest rates and bonuses, making saving up even more rewarding.

What we particularly like about this account is the daily interest feature, which means your savings can grow almost every day! Plus, the ease of application and the option to connect your account to your child’s savings make it perfect for parents who want to teach their kids about financial responsibility.

In summary, the DBS Multiplier Savings Account offers a tailored approach to saving that benefits you and your unique financial goals. Give it a try and watch your savings grow!

What We Like

- Customizable savings account options to suit individual preferences and needs

- No age requirement or minimum deposit to apply

- Ability to connect to child’s savings account

- Easy access to account through over 150 digital banking services

- Daily interest feature for regular savings growth

2. UOB One Savings

| Details | Crediting Salary on GIRO |

| Interest Rates | From 0.25% – 2.5% p.a |

| Website | https://www.uob.com.sg/personal/save/chequeing/one-account.page |

| Initial Deposit | $1,000 |

| Minimum Balance | S$5Min Monthly Average Balance of S$1,000 |

The UOB One Savings account is a fantastic choice for you if you’re seeking a high-interest account without the hassle of salary credit requirements. By spending just $500 a month on any UOB card, you’ll enjoy a boosted interest rate, making it easier to grow your savings. We love this feature because it simplifies the process of earning more from your account without any complicated calculations.

Another reason to choose UOB One is the flexibility it offers in increasing your interest rate. You can either spend an extra 15K USD through your borderless card or credit your monthly salary to the account, allowing you to plan for your retirement with ease. Overall, this account is perfect for you if you’re looking for a straightforward, high-interest savings option.

What We Like

- No salary credit requirement for higher interest rate

- Only requirement is spending at least $500 a month on any UOB card

- Boost interest rate by spending an extra $15,000 in monthly transactions

- Additional interest rate increase based on years of salary credit

- Can also be used to plan for retirement.

3. OCBC 360 Account

| Details | All in one bank account. |

| Interest Rates | Up to 2.38% p.a |

| Website | https://www.ocbc.com/personal-banking/deposits/360-savings-account |

| Initial Deposit | S$1,000 |

| Minimum Balance | S$3,000 Fall below fee: S$2 (Waived for the first year) |

The OCBC 360 Account is one of our favorites since it provides a flexible and effective approach to build your money.

You can enjoy the benefits of this Singapore savings account by simply keeping a balance of at least $1,800. The 0.1% extra you earn each month when your balance exceeds $500 is a perk we especially like.

This pushes you to save more without feeling pressed, and you’ll be astonished how much your efforts pay off in the long run. So, if you’re looking for a savings account that works for you, consider the OCBC 360 Account!

What We Like

- No salary credit requirement

- Flexible account with multiple ways to earn interest

- Bonus interest for increasing account balance above $500

- Low minimum balance requirement of $1,800 per month

- Encourages regular savings with bonus interest for balance increase.

4. MayBank Save Up Account

| Details | All in one bank account |

| Interest Rates | Up to 3.00% p.a |

| Website | https://www.maybank2u.com.sg/en/personal/saveup/save-up-programme.page |

| Initial Deposit | S$500 for Singapore Citizens and Singapore Permanent Residents. |

| Minimum Balance | S$2 monthly balance fee (if average daily balance falls below S$1,000). Waived for customers below 25 years old. |

Because it offers bonus interest based on how their various products and services are used, Maybank’s Save Up Account is one of our favorites for its innovative approach to saving. If you already have plans to use MayBank services like GIRO payments, credit card use, or house loans, this is ideal for you.

For individuals looking to optimize their money, Maybank is a great option because of the higher returns you may expect the more you interact with the company. We are pleased with the adaptability and variety of choices they offer, which address various demands and interests. Don’t pass up this chance to increase your savings with a Maybank Save Up Account because it’s a wise and profitable decision for your financial path.

What We Like

- Flexibility in meeting bonus interest requirements through a variety of Maybank products and services such as GIRO payment, salary credit, credit card spending, structured deposits, unit trusts, insurance, home loans, renovation loans, car loans, and education loans.

- Bonus interest earned for meeting certain minimum spending or investment amounts.

- High returns on savings for customers who use multiple Maybank products and services.

- No minimum deposit requirement to open an account.

- Eligibility for children’s insurance coverage and education loans.

5. Standard Chartered Bank Bonus $aver

| Details | Making bills payment |

| Interest Rates | Up to 2.38% p.a |

| Website | https://www.sc.com/sg/save/current-accounts/bonussaver/ |

| Initial Deposit | Enquire directly |

| Minimum Balance | $5 Chargeable if the minimum average daily balance falls below S$3,000 in any particular month. |

Our analysis suggests that the Standard Chartered BonusSaver savings account is an excellent option for you if you prioritize spending over saving. The account’s main benefit is that it rewards high transaction volumes, giving you the opportunity to earn money based on your spending habits.

It’s great that they offer this unique feature, as it helps a specific audience who may have difficulty finding suitable savings accounts. Keep in mind that committing at least $2,000 in transactions will allow you to reap the benefits, and although your credit score might be affected, it’s worth it.

The Standard Chartered BonusSaver is a great option for those who prioritize high transaction coverage over their credit score.

What We Like

- The Standard Chartered BonusSaver savings account is a good option for those who have to spend more than they save.

- The account offers a higher interest rate for those who make a certain amount of transactions each month.

- The account requires a minimum of $2,000 in transactions to earn the higher interest rate.

- The account is suitable for those who do not pay much attention or care about their credit score.

- The account is also attractive for its high levels of transaction coverage.

6. Bank of China SmartSaver

| Details | Salary crediting and card spender |

| Interest Rates | Up to 3.00% p.a |

| Website | https://www.bankofchina.com/sg/pbservice/pb1/202007/t20200731_18212078.html |

| Initial Deposit | $1,500 |

| Minimum Balance | No minimum balance |

In our opinion, the Bank of China SmartSaver is an excellent choice for a Singapore savings account, providing an exceptional 1.4% p.a. interest rate with less bother than other banks.

Their ‘Bonus Interests’ feature allows you to earn even more money by purchasing insurance products, using your card, crediting your salary, and making payments through GIRO or online/mobile banking.

Furthermore, with their Extra Savings Interest, you can earn up to S$1,000 in additional interest on account balances above S$80,000. You will receive big returns on your money if you meet these standards with the Bank of China. Trust us, it’s a wise investment in your financial future.

What We Like

- High interest rate of 1.4% p.a.

- Bonus Interests program with multiple options for earning extra interest, such as purchasing insurance products, meeting credit card spending or salary crediting requirements, and successfully completing bill payments via GIRO or online banking.

- No strict requirements for maintaining account balance or credit score.

- Ability to earn extra savings interest on account balances above S$80,000, up to a maximum of S$1,000,000.

- Convenience of internet banking and mobile banking for completing transactions and earning bonus interest.

More Info On Savings Accounts in Singapore

Overview Of Savings Accounts In Singapore

When evaluating which bank offers the highest interest rate savings accounts in Singapore, it’s essential to compare the features and benefits each offer provides. Interest rates can vary significantly depending on how much money you deposit into your account and what type of fees the bank charges.

Additionally, some banks provide bonus incentives for customers who open up multiple accounts or invest regularly with their services. Furthermore, it’s important to consider any additional perks such as online banking capabilities or rewards programs offered by certain institutions before signing up for an account.

What To Consider When Choosing A Savings Account

When it comes to high-interest savings accounts, look for one that offers an attractive rate of return on deposits made into your account. You should also compare different banks’ offerings, since each bank will have its own set of features and benefits available with their particular accounts.

Additionally, check what other fees or charges may come along with the account – these can vary greatly between different providers. Finally, some banks offer bonuses like cashback rewards or loyalty points which could make them more appealing options than others.

Comparing Savings Accounts Interest Rates

When it comes to finding the best rate, it pays to do some research and compare offers from multiple providers. Savings account comparisons should include factors such as minimum balance requirements, fees associated with each account, and any special features or benefits offered by the provider.

It’s also important to consider whether an online-only bank might be a better option than traditional brick-and-mortar banking institutions when considering which type of savings accounts will give you the highest return on your money.

From there, you can make an informed decision about which savings account is right for you – one that both helps you save more money now and provides long-term benefits down the line.

Types Of Savings Accounts In Singapore

There are several different types of savings accounts available in Singapore, including:

- Basic savings accounts: Basic savings accounts are the most basic type of savings account, offering a low interest rate and limited features. They are a good choice for individuals who are just starting to save and don’t need a lot of features.

- High-yield savings accounts: High-yield savings accounts offer a higher interest rate than basic savings accounts, making them a good choice for individuals who are looking to earn more on their deposits. These accounts may have higher minimum balance requirements or other fees.

- Flexible savings accounts: Flexible savings accounts allow individuals to withdraw and deposit money more frequently than other types of savings accounts. They are a good choice for individuals who need access to their savings on a regular basis.

- Joint savings accounts: Joint savings accounts allow two or more individuals to open and manage an account together. They are a good choice for couples or families who want to save money together.

Features Of Savings Accounts In Singapore

Some of the features that may be offered by savings accounts in Singapore include:

- Interest on deposits: Most savings accounts offer interest on deposits, allowing savers to earn money on the money they put into the account. The interest rate may vary based on the type of account and the balance in the account.

- Minimum balance requirements: Some savings accounts may have minimum balance requirements that must be met in order to maintain the account or earn interest.

- Fees: Some savings accounts may have fees for services such as ATM usage or account maintenance. It is important to understand what fees may apply to a savings account before opening it.

Benefits Of High-Yield Savings Accounts

Here are some key benefits of using a high-interest savings account:

- 1) Earn more money – High yield savings accounts tend to offer significantly higher annual percentage yields (APYs) compared with other types of bank deposits, meaning that your money will grow faster over time.

- 2) Easy accessibility – Most online banks make it easy for customers to transfer funds between their checking and saving accounts without any hassle or fees. This allows you to quickly move your funds around if needed.

- 3) Safety – Your deposits with an FDIC insured institution like most online banks come with government protection up to $250,000 per depositor making them safe investment vehicles.

- 4) Low minimum balance requirement – Many banks don’t require an initial deposit or have low opening balances which makes starting a new account affordable even for those on tight budgets.

- 5) Flexible terms – You can usually choose how long you want to keep your money invested in the account before withdrawing it so there’s no pressure when deciding what length fits your needs the best.

Comparing Banks And Their Savings Accounts

To make sure you get the perfect fit for your needs, here is a breakdown of what to look out for:

- Compare bank accounts – Different banks offer different features like higher deposit amounts or lower minimum balance requirements. It’s important to consider which ones suit your individual financial situation.

- Look at available features – Some accounts come with bonus rewards such as cashback offers, while others provide access to mobile banking apps or other convenience services. Check what each one has to offer before making a decision.

- Consider ongoing fees – When looking at different savings accounts, be mindful of any ongoing fees that may apply over time. Make sure you understand how these will affect your overall costs so there aren’t any surprises down the line.

- Read up on terms & conditions – Every bank has its own terms and conditions governing their accounts, so take some time to read through them carefully before signing up. This way you can avoid any unexpected charges or restrictions later on.

By doing thorough research into various bank accounts, you’ll be able to determine which one is most suitable for your financial goals.

Different Types Of Savings Accounts

The first type is a basic savings account. This kind of account typically offers lower interest rates compared to other kinds of deposit accounts but may come with certain perks like free ATM withdrawals or access to online banking services.

For those looking for higher returns on their deposits, there are higher-yield savings accounts which usually require minimum balances and often have restrictions on how much money you can withdraw each month. These generally provide higher interest rates than basic savings accounts – up to the highest savings account interest rate available in Singapore.

Another option is an FDIC insured bank certificate of deposit (CD). CDs typically offer fixed terms from three months up to five years and the longer your term, the more likely you’ll be able to get one of the highest interest rate for savings account Singapore has to offer.

However, should you choose to close your CD before its maturity date, you will face early withdrawal penalties so this might not be suitable if you need immediate access to funds.

Deciding between convenience versus high returns requires careful consideration since each individual will have varying requirements depending on their financial situation and future plans.

Choosing A Savings Account Based On Interest Rates

Researching the various interest rates available on Singaporean savings accounts will help narrow down which type of account would best suit your needs.

You don’t need to feel overwhelmed when searching for the perfect savings plan. Take a look at each option and compare their respective interests rates – this way, you’ll get closer to finding the best savings plan in Singapore for you!

Pros And Cons Of Different Savings Accounts

High-interest savings accounts are great if you want higher than average returns on your investments – they offer some of the best interest rates in Singapore. However, these may come with high fees or other restrictions that could make them less attractive overall.

On the flip side, low-fee savings accounts often provide lower interest rates but no hidden charges, making them more suitable for those who don’t need immediate access to their funds.

No matter what kind of savings account you choose, it pays to do your research before committing. Look out for minimum balance requirements, monthly fees or penalties for early withdrawal – all factors that should influence your decision when choosing a savings account based on its interest rate.

Making The Most Of Your Savings Account

The first step is researching which banks offer promotional deals or higher-than-average rates on their products.

Don’t forget hidden fees, transaction limits, ATM access points, online banking capabilities and so on – these small details add up quickly and could mean the difference between a great return on investment or mediocre returns at best.

Frequently Asked Questions (FAQs)

Check out some of the Frequently Asked Questions (FAQs) about Savings Accounts in Singapore.

Which Bank Gives Highest Interest Rate On Saving Account In Singapore?

CIMB FastSaver is a savings account that offers a competitive base interest rate ranging from 0.80% to 1.50%, depending on the amount of money saved. This high interest rate sets CIMB FastSaver apart from other savings accounts on the market and may make it a particularly attractive option for individuals looking to maximize their earning potential on their deposits.

What Are The 3 Main Savings Accounts?

Money market accounts offer higher interest rates and may have higher minimum balance requirements.

Certificate of deposits are accounts that require a fixed deposit for a set term, and offer a higher interest rate in return. It is important to understand the differences between these account types and choose the one that best fits your needs and goals.

What Is The Biggest Disadvantage To Savings Accounts?

While savings accounts can be a convenient and secure way to save money and earn interest, they may also come with fees that can impact your earnings. For example, some financial institutions charge a monthly fee if the balance in the account falls below a certain minimum requirement.

It is important to be aware of any fees that may apply to a savings account and consider how they may affect your overall earnings. By understanding the fees associated with a savings account, you can make an informed decision about which account is the best fit for your needs and goals.

Are There Any Fees Associated With Opening A Savings Account?

It can be daunting to consider all of the options when searching for a savings account. After spending hours researching, it’s easy to feel overwhelmed and uncertain about where to start. But fret not – there is one important factor that you must keep in mind: fees associated with opening up a savings account.

Are you wondering if there are any hidden charges or unexpected costs? Well, we’ve got some good news for you! Generally speaking, most banks don’t charge customers anything for setting up an individual savings account. However, you should always double-check with your bank to make sure this is the case before signing any paperwork. By doing so, you will be able to plan ahead effectively and ensure that you won’t have any unpleasant surprises down the line.

Making smart financial decisions requires thorough research and understanding of what’s available on the market. At times it may seem like quite a challenge – but getting informed first could save time and money over time. So take your time researching and exploring different accounts, find out more information from your bank’s customer service representatives and then choose the right one for your future goals!

Can I Use My Savings Account For Investments?

Savings accounts are an excellent way to put away money for the future, but can you use them for investments? With interest rates seemingly stagnated and financial markets turbulent, investors may want to look into different strategies. Many people may not be aware that savings accounts offer a range of investment opportunities – so let’s dive in!

Take my friend Arthur as an example; he had been saving a small sum each month with his local bank, never expecting it to amount to anything particularly substantial. However after a few years, when he decided to take stock of his finances and check out what was available on the market, he discovered that by using cleverly-timed transfers between banks, he could make more money than ever before through investing in savings accounts.

Investing in savings account is becoming increasingly popular due to its inherent safety features:

• Low Risk: Savings accounts typically have low risk associated with them compared to other traditional forms of investments such as stocks or bonds. This means your capital will remain safe even if there are economic fluctuations in the market.

• High Returns: Depending on the type of account you open and how much you save each month, returns can be significantly higher than those offered by regular deposit schemes. For example, many online banking platforms offer competitive rates which enable customers to earn up to 3% on their deposits over 12 months.

The benefits don’t end there though; depending on how well you manage your account (and how savvy you become at transferring funds within a short time window) you may also gain access to additional perks like rewards points or cashback incentives from partner organisations – all without taking any extra risks beyond opening an account! So why not give it a go? You’d be surprised just how far your hard-earned money could stretch with the right strategy in place.

How Do I Make A Deposit Into My Savings Account?

Making a deposit into your savings account is easy and straightforward. You can use several methods to do this, such as online banking or using an ATM machine. Here are four simple steps to get you started:

1) Log in to your bank’s website or mobile app with the correct credentials.

2) Select the ‘deposit’ option from the list of services provided by your bank.

3) Enter the amount you wish to transfer and select the source account from which you want to make the payment.

4) Confirm all details and click submit for processing.

Once done, you should be able to see the deposited funds credited to your savings account immediately. If not, then contact customer service at your bank for help. In addition, it’s important that you keep track of all transactions made on your account so that there are no discrepancies later on. Taking these few extra minutes will save time and effort when making deposits in future!

Are There Any Restrictions On Withdrawals From A Savings Account?

The truth is that almost every savings account has some sort of limitation on how much you can withdraw at any given time. This may vary depending on the bank or financial institution you’re using, but they all have the same goal: to help you save your hard-earned money and ensure that it remains safe.

Most banks will also require customers to provide identification documents before allowing them access to their funds, as well as impose other security measures such as two-factor authentication.

No matter which type of savings account you choose, always make sure to read through each institution’s terms and conditions thoroughly. Familiarize yourself with all the limitations placed on your deposits and withdrawals; understanding these rules is essential if you want to make the most out of your account while keeping your finances secure!

Can I Access My Savings Account From Anywhere?

For the most part, accessing a savings account from any location will depend largely on the type of bank or institution with which the account has been opened. Generally speaking:

– Some banks may offer mobile apps or online banking platforms so their customers have 24/7 access to funds stored in their accounts;

– Other banks may operate solely through physical branches and ATMs, limiting users’ abilities to withdraw cash or check balances remotely;

– Still others may provide both options so users can choose according to their needs and preferences.

– Additionally, some financial institutions may require certain user authentication measures such as passwords or biometric scans before allowing remote access;

– Finally, many modern banks are now offering digital wallets and other payment services that allow users to make payments and transfers directly from one account to another without needing any physical cards or paper currency.

No matter what type of bank you use – whether digital only, brick & mortar only, or a combination of both – there is likely a way for you to conveniently manage your savings wherever you are located. With innovative tools like these available now at our fingertips, it makes sense why people around the globe increasingly prefer using digital banking solutions over traditional ones!

Conclusion

In conclusion, a savings account is one of the most reliable and advantageous ways to save money. It offers users the opportunity to accrue interest on their deposits, as well as access to funds at any given time without much hassle.

With so many options available in Singapore nowadays, it can be difficult to decide which bank best suits your needs. Nonetheless, with careful consideration of fees associated with opening an account, investment opportunities, ease of deposit and withdrawal process and accessibility from anywhere – you are sure to find the right savings account for yourself!

We have reached the end of the article! We’re glad that you made it this far! Now that you have our list of the best savings accounts in Singapore, do let us know if you feel that there are others that should be part of this list!

We hope this article that we have reviewed has been helpful for you! If you find this article helpful, do check out other related articles in Singapore!